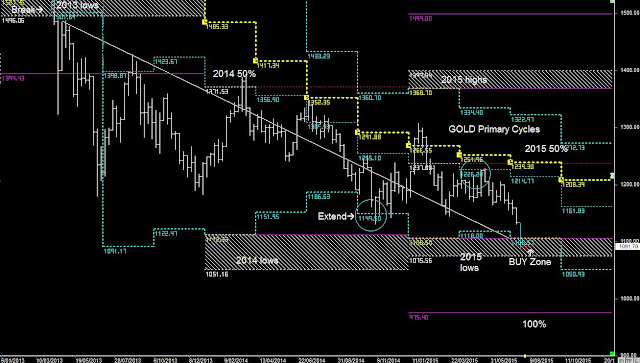

GOLD Primary & Weekly Cycles

Long term GOLD continues to remains a BUY & HOLD.

Short-term Weekly cycles still look positive, as long as price can remain above the Weekly lows. (previous report)

It was the daily close below the Weekly lows @ 1122 and the continuation downward the very next day that set-up weakness into the 4th Quarter lows (Random Support)

There are now two short-term patterns in play in the last month of the year (December)... 4th Quarter lows @ 1054 hold, but then another way downward in 2016.

Or a further collapse over the next couple of week towards the 100% level @ 975 ( BUY Zone)

SILVER Primary Cycles

Silver should complete the move down into the 2015 lows :- with two random support zones around 13.65 & 12.85.

The support zones are random long-term BUY zones, as the cycles do favour another push downward early in 2016.