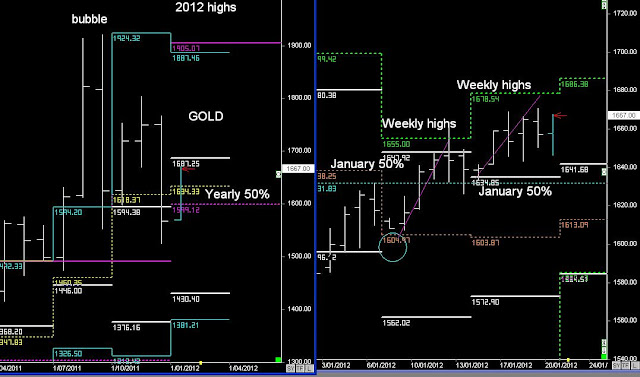

GOLD Primary and Weekly cycles

GOLD is following a 2-month wave pattern during the first Quarter from the January 50% level towards the February highs

potential pattern would be a short-term reversal towards the February 50% level and then a continuation up towards the February highs.

SILVER Primary and Weekly cycles

Silver's price action was to rise back towards the Yearly 50% level in 2012 @ $34.51.

This level could act as a resistance zone, but when we look for the Weekly cycle patterns....

there could be a further rise upwards, as part of a 2-month wave extension during the 1st quarter.