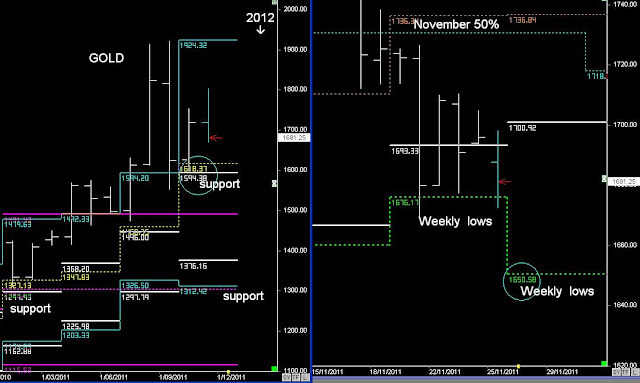

GOLD Primary and Weekly cycles

GOLD is starting the new Primary cycle below the 2012 Yearly 50% level, which is bearish...

It could move above 1599 durinng January and test the Monthly 50% level @ 1631, but those levels are seen as resistance.

At this stage my view is that the trend is going to continue lower and move down into the January lows, with first Quarter support around 1430 to 1492...

And then a possible move down into the 2012 Yearly lows by the 3rd Quarter.

SILVER Primary and Weekly cycles

First BUY zone on Silver is around the January lows and the first Quarterly level @ 24-25.50.

The swing target is the 1st quarterly 50% level @ 32.69, and as high as the Yearly 50% level @ $34.51

The Yearly 50% level is seen as resistance...

For those that want to look to BUY Silver for the medium to long term (3-months & longer)....

my view is that it will struggle to move higher than the Yearly 50% level for the first 6-months.

AND you DONOT want to see Silver trading below Yearly support (19.85 to 22.65)...

as it will likely extend to new lows into 2013.