GOLD Primary cycles

Gold has continued up into the August levels @ 1411 and stalled, helped by the ongoing troubles in the

Middle East, but in my opinion it was going to move up to that level regardless once it moves above the August 50% level.

Middle East, but in my opinion it was going to move up to that level regardless once it moves above the August 50% level.

The trend for the rest of the year is based on the September level @ 1397 (next week)...

It's either going to drift back down into the BUY zone @ 1337, as part of a larger Primary trend down into the 2014 lows....

However, there is a larger rotation that could take place that sees gold rotate upwards, as part of a move towards the 2014 Yearly 50% level :- 1491 to 1526

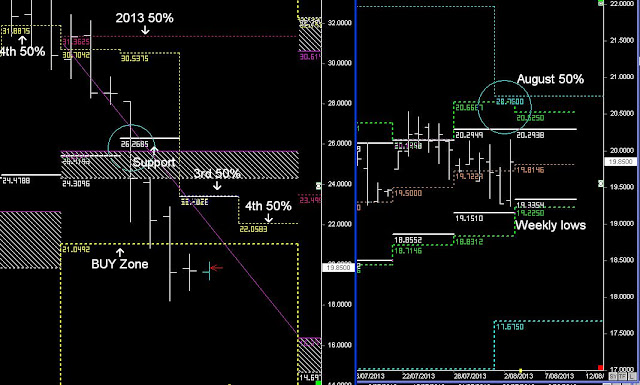

SILVER Primary Weekly cycles

The previous report mentioned that the BUY zone at 21.049 was seen as resistance, as part of a larger Primary trend from the 2013 Yearly lows towards the 2014 Yearly lows.

That changed once price moved above the August 50% level and broke out of the Weekly highs.

Even though there could be a flight back into the precious metals because of the Middle East, and also the FED making waves about cutting back on stimulus, the Primary cycles still suggests that the Primary lows @ 2013 will form resistance and continue lower in 2014.